When people talk about earning a six-figure income, they are referring to a salary that falls between $100,000 and $999,999. This figure represents a significant milestone in financial success and often serves as a benchmark for many aspiring professionals. Understanding how much 6 figures actually is and the implications it has on one’s lifestyle, savings, and financial goals is crucial for anyone looking to improve their financial literacy.

In this article, we will delve into what a six-figure income means, how it can affect your quality of life, and the strategies necessary to achieve this level of earnings. We’ll also explore the different fields where six-figure salaries are common and provide insights into the lifestyle changes that often accompany such earnings. By the end of this article, you will have a comprehensive understanding of six-figure incomes and how to navigate your financial journey toward achieving this goal.

Whether you are currently earning a five-figure salary and aspiring to climb the income ladder, or you are simply curious about the financial implications of a six-figure income, this guide will equip you with the knowledge you need. Let’s explore the world of six figures and what it means for your financial future.

Table of Contents

- What is Six Figures?

- Understanding the Income Range

- Common Six-Figure Jobs

- Lifestyle Changes with a Six-Figure Income

- Savings and Investment Strategies

- Challenges of Six-Figure Incomes

- How to Achieve a Six-Figure Income

- Conclusion

What is Six Figures?

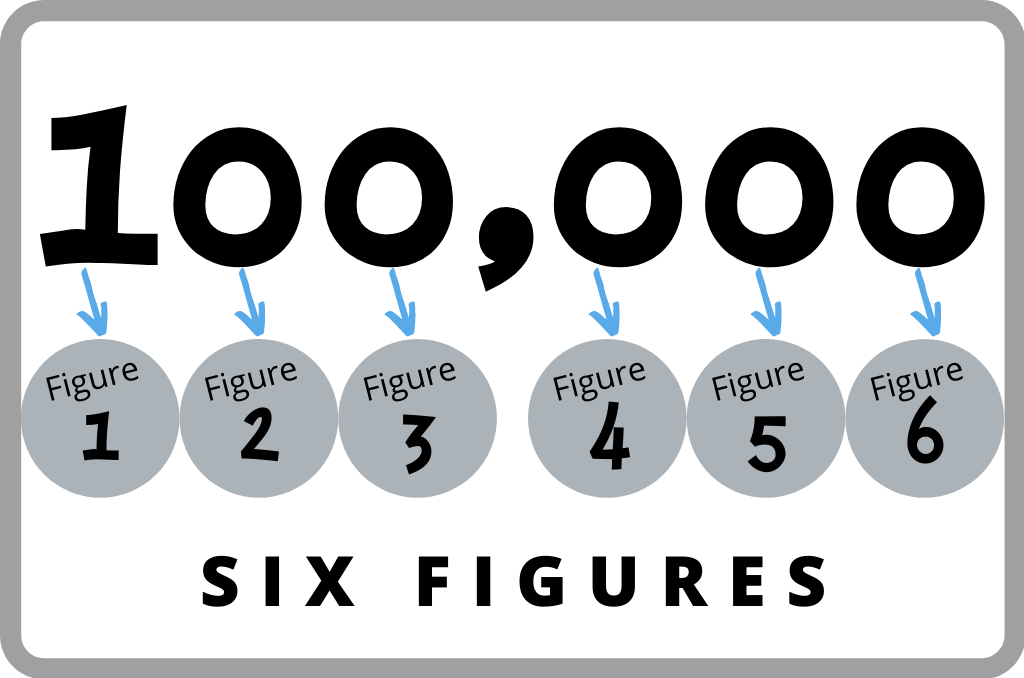

A six-figure income refers to a salary that ranges from $100,000 to $999,999 annually. This range signifies a considerable earning potential and often indicates a higher level of expertise, experience, or education in a given field. Earning six figures is often associated with a comfortable lifestyle, the ability to save for retirement, invest in assets, and afford luxuries that may not be possible on a lower income.

Understanding the Income Range

To better understand the implications of a six-figure income, it’s essential to break down the income range:

- Low Six Figures: $100,000 - $399,999

- Mid Six Figures: $400,000 - $699,999

- High Six Figures: $700,000 - $999,999

Each segment of this range carries different financial responsibilities and lifestyle implications. For instance, someone earning $100,000 may have different financial priorities compared to someone earning $800,000.

Common Six-Figure Jobs

Many professions offer the potential to earn a six-figure income. Below are some of the most common fields where six-figure salaries are prevalent:

Tech Jobs

The technology industry is known for its high-paying jobs, with many positions easily reaching six figures. Some examples include:

- Software Engineer

- Data Scientist

- IT Manager

Medical Jobs

Healthcare professionals often enjoy lucrative salaries. Some common six-figure medical jobs include:

- Physician

- Dentist

- Nurse Anesthetist

Finance Jobs

The finance sector also offers various six-figure positions, such as:

- Financial Analyst

- Investment Banker

- Financial Manager

Lifestyle Changes with a Six-Figure Income

Achieving a six-figure income often leads to significant lifestyle changes. Here are some common shifts that individuals may experience:

- Improved Standard of Living: Individuals can afford better housing, dining, and leisure activities.

- Increased Savings: With higher income comes the ability to save more for retirement and emergencies.

- Investment Opportunities: A six-figure salary allows for investments in stocks, real estate, and other assets.

Savings and Investment Strategies

To maximize the benefits of earning six figures, it’s vital to adopt effective savings and investment strategies:

- Emergency Fund: Set aside 3-6 months of living expenses in a high-yield savings account.

- Retirement Accounts: Contribute to 401(k) or IRA accounts to benefit from tax advantages.

- Diversified Investments: Invest in stocks, bonds, and real estate to build wealth.

Challenges of Six-Figure Incomes

While earning six figures comes with many benefits, it also presents unique challenges:

- Higher Tax Bracket: Individuals may face a higher tax rate, impacting take-home pay.

- Increased Expectations: Higher income can lead to heightened expectations from employers and peers.

- Work-Life Balance: Many high-paying jobs demand long hours, affecting personal time.

How to Achieve a Six-Figure Income

For those aspiring to earn a six-figure salary, consider the following strategies:

- Invest in Education: Obtaining advanced degrees or certifications can enhance earning potential.

- Network Effectively: Building relationships in your industry can open doors to high-paying opportunities.

- Develop In-Demand Skills: Focus on acquiring skills that are highly sought after in your field.

Conclusion

In summary, a six-figure income represents a significant financial achievement that can lead to an improved quality of life, increased savings, and greater investment opportunities. However, it also comes with challenges that require careful planning and management. By understanding the implications of earning six figures and implementing effective strategies to achieve this goal, you can navigate your financial future successfully.

We encourage you to share your thoughts on this topic in the comments below, and feel free to explore our other articles for more insights on personal finance and career development.

Thank you for reading! We hope to see you back for more informative content.

You Might Also Like

B Flat: Understanding The Importance And Applications Of B Flat In MusicHow To Stop Itching Down There Immediately: Effective Solutions And Tips

Ultimate Vegan Supper Ideas: Delicious And Nutritious Meals To Satisfy Every Palate

Nemesis: Understanding The Concept And Its Significance

Understanding The NKJV: A Deep Dive Into The New King James Version Of The Bible

Article Recommendations

- Growth Hacking_0.xml

- How Old Is Miguel Diaz

- 76 Out Of 80

- Arianna Lima 2024

- Wallet With Pull Tab

- Efficient Strategies_0.xml

- Jeremy Wariner Net Worth

- Chandie Yawn Nelson

- Brand Building_0.xml

- Long Handled Post Hole Diggers